Garbage And Lies - Part 1 - Buying A House

:date: 2024-03-08 21:02 :tags:

This is a three part series chronicling my experience of buying, owning, and selling a house in Buffalo, NY. It is long because there is a lot material here that I've been keeping private. Now that this house is no longer a liability to me, I want to share my experience so that others (especially my future self) can learn from it. You can find part two here and part three here.

American Parasites

Becoming a ne'er-do-well is not something that intelligent people are usually forced to do. I feel like this naturally limits the damage of miscreants. However, the most glaring exception, at least in the USA, is the synthesis of incompetence and skulduggery found in the real estate profession. The world of real estate is filled with incompetent people who are trying to exploit you. And weirdly succeeding.

My grandfather was an intelligent guy. He hated real estate agents mostly because they promoted racism. The real estate profession's "past policies in support of racist practices, including steering, redlining, and creating covenants that prohibited nonwhite people from living in certain communities" were exactly the kind of despicable that I've come to expect from the real estate profession. Amazingly, that quote is from the wretched hive of scum and villainy known as the National Association Of Realtors as they openly admit some of their former (?) awfulness. His was an unpopular opinion at the time but I think we can credit my grandfather with being absolutely right on this one. In the words of the NAR president (in 2021), "What REALTORS® did was an outrage to our morals and our ideals. It was a betrayal of our commitment to fairness..."

My problem with the modern NAR and real estate agents modeled on their prototype is that they continue to be an outrage to our morals and ideals. And that's not just my view. Did you know that in 2023 a federal jury found the NAR guilty of colluding to inflate real estate commissions? They were fined some $1.78 billion in a lawsuit representing 260,000 homes (about $7k per house — those keeping score should adjust for inflation). That is in just three states! Their damage is obviously far more pervasive. Rather than "making markets", I believe their flagrant rent seeking has mired the country in sticky transaction costs broadly inhibiting economic prosperity. We don't even need to delve into the deleterious effects of them putting substantial numbers of people into ill-advised homes during the housing bubble and other major societal fiascoes.

To attempt a neutral perspective on why it is hard for me personally to trust real estate professionals, I asked my robot best friend, "Can you summarize how the bestselling book Freakonomics portrays the incentive structure of real estate agents?" This reasonable and simple response is the most important thing you should be keeping in mind when dealing with real estate agents. Read this carefully.

ChatGPT:

"Freakonomics" suggests that the incentive structure for real estate

agents can sometimes lead to conflicts of interest with their clients.

Since real estate agents receive only a small percentage of the

incremental price increase in home sales (for example, 1.5% of a

$10,000 increase is only $150), they might have an incentive to

encourage a quick sale rather than holding out for a higher price that

would benefit the seller more. The book presents data showing that

real estate agents tend to keep their own homes on the market longer

and sell them for higher prices compared to their clients' homes. This

difference illustrates how the agents' commission-based incentive

structure might not always align with the best financial interests of

their clients.This was all simply awful back when houses cost a lot of money. Now that houses cost an absurd amount — I believe jumbo is an actual relevant word — this misaligned incentive structure is more like the magnitude of having your car stolen whenever you buy or sell property. The summary for this article in The Economist says "Estate agents get a bad rap all over the world. In America they deserve it". They use the word "racket" and report that 0.4% of GDP — about three times the average of other developed countries — is pissed away on real estate transactions.

I'd seen housing bubble madness first hand in San Diego and when I left that city for Buffalo, I was happy that the real estate market was much more realistic. I did however have enough dealings with real estate agents to know that they were not to be trusted. Like any good confidence trickster, they will appear to be your friend, but they are not your friend. I knew this and still I underestimated the danger.

Shopping

I arrived in Buffalo at the beginning of August 2018. I was out walking one day and I lingered outside of a real estate agent's office looking at the listings. One of the reasons for leaving San Diego was to finally get away from the insecurity and shared wall obnoxiousness of apartment life and I knew I wanted to purchase a house. The agent came out and accosted me with her pitch to show me houses. Fine. I actually didn't need any help finding a house since my requirements were pretty straightforward and mostly location oriented. But when you are the buyer, the "services" of an agent are paid for by the seller. So why not? And before that 2023 collusion ruling it probably would have been impossible to save on the commission in any way by not having one.

The agent showed me her listings first obviously and what is strange is that the house I eventually bought was one which I was not aware of. Why was it not showing up in my own searches? One would hope that the internet would be improving buyer and seller information channels but I'm not so sure. (There's a whole can of worms involving Akerlof information asymmetry and how the ostensible objective of real estate agents to promote information exchange is actually completely false — it is usually in their best interests to keep facts murky.) The agent kept repeating the mantra "Williamsville Schools" over and over like some kind of Jedi mind trick. Maybe that is some kind of race related shibboleth but what it really means in practice is that people who live in the afflicted area will be hit with a whopping huge school tax bill every year.

I almost didn't need to see the inside of the house. Some of it was livable; much of it was horrendous. If the previous owners were not complete idiots, all evidence they left behind was to the contrary. But the location was extremely good.

This is right behind the house.

Much more of that kind of thing. This is the house's backyard.

One of my superpowers is that I can learn more about a neighborhood in an afternoon than someone who has lived there all their life. The secret is viewing it by bicycle. This particular property was hooked up to a really magical network of bike paths and walking trails through a nature preserve. The phrase "almost Dutch" is reasonable here. You can rebuild the house, but you can't rebuild the location. Of course the listing mentioned none of its true appeal. By the third week of August, I had made an offer on the house.

My second mistake (we'll return to the first in a bit) was hiring an inspector. Unlike normal people, I'd be paying cash for the entirety of the purchase price and needed no mortgage. Because I, and not the bank, would own the house nobody but me cared if it got looked at by a professional house inspector. I actually wasn't quite sure if it was a sensible expense or not but in the end I did it. I figured that maybe someone who knew homes of the area better than I did would provide a valuable perspective.

That may have been true had I not made the critical mistake of assuming the agent was there to help with things like recommending necessary professionals. Of course she knew a "good" inspector. Of course she did. And this guy was a complete idiot and/or was being paid by both me and the agent. The main red flag at the time was that he did not check the attic at all because he could not access it. Dude, that is literally your job! Knowing how to access attics in the houses of the region is exactly what he was hired for. (N.b. the answer is quite easy, so no excuses.)

The main thing I was concerned about was that the vents were properly vented. I'd just lived six years in an apartment with a non-venting stove vent that was worse than useless and was keen to do better. I was assured the stove did vent outside and that all the vents in the house vented properly.

In actual fact: three of the four vents were astonishingly stupid in their configuration and did not vent at all. The kitchen one had been ducted to actually vent outside through the floor but the builders covered up this ducting and it went unused for 45 years! I lived with that for four years before finally fixing that myself, and for the first time, the original duct work could actually vent the kitchen as originally designed. The vents in the upstairs bathrooms were much more of a shitshow. Once I saw what was going on up there, I knew I had an emergency on my hands. Both of the shower vents vented humid shower air directly into a sealed attic. I can't quite say if this is the absolute acme of stupidity in the configuration of this house but it was pretty high on the list.

Purchase

But we're getting ahead of ourselves. I jumped ahead to the vent situation to highlight just how much of a waste of money the "inspector" was. Before I could fix these (not really inspected) problems, I had to actually buy the place. Let's return to my first major mistake: signing the purchase agreement that was presented to me. Sure I was told that the purchase process could sometimes take a few weeks due to financing issues. I naively thought that arriving with cash in hand ready to transact would considerably speed up the process. Wrong.

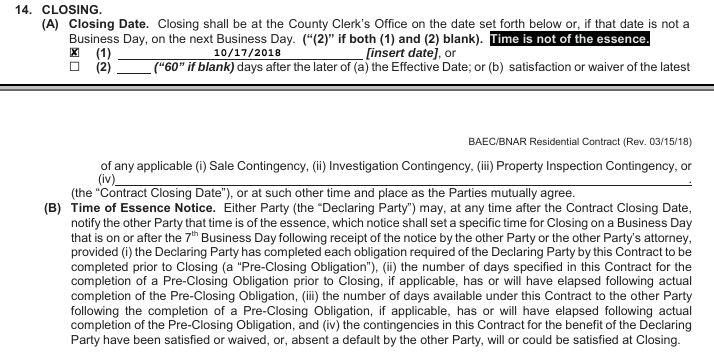

The first mistake I made was not attending to the details of the purchase agreement carefully enough. Oh sure, I read it. Carefully, as is my habit. But at that time I was not clear on exactly what the phrase "time is not of the essence" was all about. The duplicitous agent was representing both parties — something that is illegal in some states and definitely something to avoid. She told me that the sellers were ready to move out right away. She indicated the contract was setup in such a way that we could be flexible with the closing and make it happen sooner than listed. However, in the murky language of real estate contracts there is only one goal: secure the commission. That's it. What that means in cases like mine is that the most important thing is getting me — the money — locked in to buy the house. That's nearly as good as me buying it to the agent. But to me, who is at this point homeless and needs to do laundry, not owning it is very different than having a place to live!

Despite having their house for sale, I doubt the sellers were anywhere near ready to move. That had been a lie. If the seller decides they want to live in the house for another random block of time, say six months, while you, the purchaser, remain homeless, well, you're obligated to wait for them. In fact, I never could quite figure out what the limitation was on that. Years? At some point, you can start some kind of legal process to extricate yourself from this kind of open-ended ensure-the-commission-at-all-costs contract but it will require professional legal help.

When I told my real estate cretin that I was surprised to learn that I was on the hook for the house for possibly months even if the sellers failed to transfer possession of a house for me to live in, she assured me that it was simply to help to prevent prematurely evicting people who might then be homeless. She said this to me while knowing I was homeless! At the end of October when I had planned to move in and the sellers were showing no sign of being at all ready to leave, I did have my attorney start making inquiries about how to get out of this deal as soon as possible. That's when the agent started fearing for the commission and started taking the closing date a little more seriously.

To provide the correct learning opportunity, see how this purchase contract looks to you. Does it look like you'll be required to buy a house that you don't get to live in for some arbitrary amount of time after the date specified?

This is a lesson that the closing date can be manipulated to favor the odds of the agent getting a commission and not you getting a house promptly. It also teaches us that the value of an empty house is much higher than one where incompetent people still need to get their shit together before moving out.

I made the offer on 2018-08-20 and the closing date I was assured by the agent would be roughly a month later. After many more painful weeks of having nowhere to live, I finally took possession of the place on October 17, 2018. It wasn't when the agent promised, but my attorney helped ensure it was at least the date stated in the contract.

Ownership

A home inspector is hit or miss, but today you must always get title insurance! The insanity of the housing fiasco almost 20 years ago lives on in the deeds of property all over the country. You may have been like me and smugly wondered who are these idiots taking out absurd HELOC loans — secured against their houses — to go on vacation and buy stupid shit? Well, that certainly wasn't going to have anything to do with me, right? Wrong! If you're ever shopping for a house that was built before (or after) 2007 you need to really understand that there is a very strong chance that some previous "owner" piled up all kinds of absurd loans, effectively giving true ownership of the property to random and sundry third parties.

Speaking of real estate rackets, Chicago Title is one. These weasels used to incompetently exploit people by betting them that a well regulated legal system would in fact legally follow the regulations. For almost everyone this was required because normal people don't buy houses — banks buy houses and normal people pay off loans. And the bank is fine with you paying a premium to make absolutely sure no freak financial quirk will sneak into their portfolio.

I did not get a mortgage and was actually under no obligation to get title insurance. Cutting that cost is definitely something I could imagine contemplating. Thankfully I opted to get title insurance.

Thankfully... One day (2019-03-18), I got a notice that said I owed $46,186.43 due to a lien on my house. Apparently the idiot former owner had done the normal American idiot thing and taken HELOCs like crazy. I contacted the attorney I had used to buy the house (an attorney is required in the state of NY for real estate transactions) and to his credit he did sort all of this out. He got Chicago Title to pay out a claim on the insurance and made the problem go away. And it only took 13 months!

The lesson is clear: you can not research the title history yourself well enough to assure yourself that it is clear. The normal way buyers do this research is by paying for a "title search". The number one player in this area is Chicago Title, the same pirates who will insure you against them basically not doing their job. I suspect they never really did any actual proper title research but just charged to insure what it would take to avoid liability on the few that were encumbered. However, given the insane loan promiscuity of the 2000s either they'll need to rethink that or, much more likely, look for the cost of title insurance to go way up. If you want a proper title history search undertaken so that you can be assured that you won't be hassled by legal entanglements years after buying your home, I'm not sure that is possible today unless you personally hold the office of the county clerk.

On 2020-04-23, a year and a half after closing, I finally owned my house.

Timeline

| 2018-08-12 | first toured the house |

| 2018-08-16 | first offer |

| 2018-08-20 | purchase contract signed |

| 2018-09-20 | expected to close and move in |

| 2018-10-17 | closing - move in |

| 2019-03-18 | notice of a $46k debt secured with the house |

| 2020-04-23 | finally own the house properly |